how to calculate taxes taken out of paycheck in illinois

The illinois paycheck calculator will calculate the amount of taxes taken out of your paycheck. Overview of illinois taxes illinois has a flat income tax of 495 which means.

Millions Of Americans Could Be Stunned As Their Tax Refunds Shrink The Washington Post

What percentage is taken out of paycheck taxes.

. For example if an employee earns 1500 per week the individuals. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. Supports hourly salary income and multiple pay frequencies.

Some states follow the federal tax. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Illinois Hourly Paycheck Calculator. The wage base is.

So the tax year 2022 will start from July 01 2021 to June 30 2022. The Illinois Paycheck Calculator uses Illinois. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed.

Additional Medicare Tax. It is not a substitute for the advice of. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes. Just enter the wages tax withholdings and other information required. This free easy to use payroll calculator will calculate your take home pay.

It can also be used to help fill steps 3 and 4 of a W-4 form. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois. Seconds until January 1st.

The state tax year is also 12 months but it differs from state to state. After a few seconds you will be provided with a full breakdown of the. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

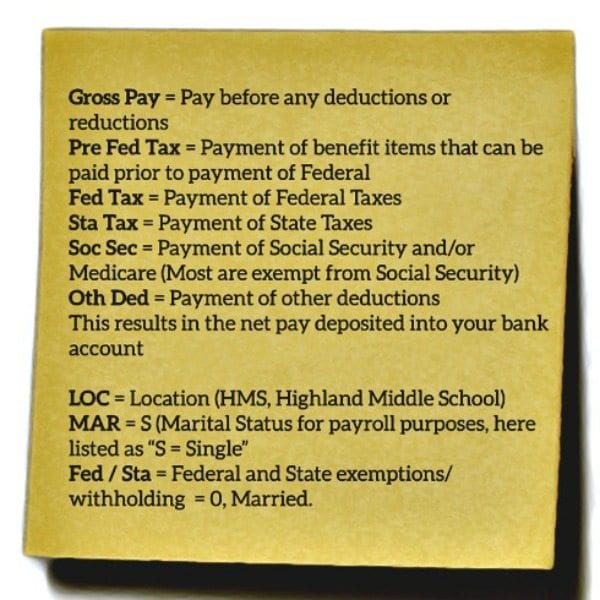

Understanding Your Teacher Paycheck We Are Teachers

Illinois Paycheck Calculator Smartasset

Illinois Paycheck Calculator Smartasset

What Is Income In An Illinois Child Support Case

Llc Tax Calculator Definitive Small Business Tax Estimator

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Illinois Retirement Tax Friendliness Smartasset

A Complete Guide To Illinois Payroll Taxes

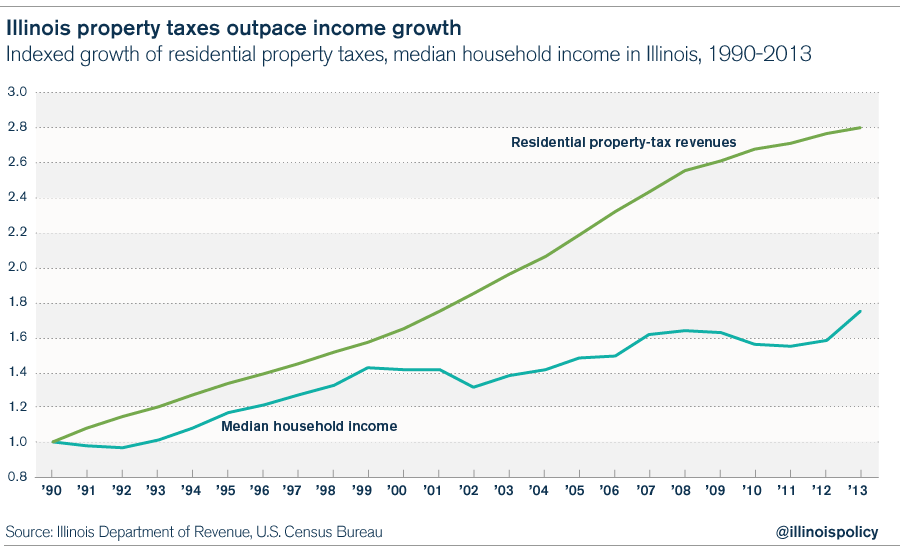

Home Is Where The Hurt Is How Property Taxes Are Crushing Illinois Middle Class

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

![]()

Illinois Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Illinois Estate Tax Everything You Need To Know Smartasset

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Are Car Accident Settlements Taxable In Illinois Hipskind Mcaninch Llc

Illinois Hourly Paycheck Calculator Gusto

Illinois Paycheck Calculator Smartasset

I Live In Illinois Work In Wisconsin How Do I Pay Income Tax